Transition Plan for climate change mitigation

Gunvor has chosen to be part of the solution on climate matters and to support the energy transition. To this end, it is looking at ways to improve the carbon footprint of its activities.

In particular, it has set CO2 reduction trajectories for its Scope 1 and 2 emissions and for its Scope 3 emissions in relation to its shipping. Scope 3 emissions from trading activities are actively monitored.

In 2021, Gunvor established a dedicated vehicle, Nyera to invest in non-hydrocarbon initiatives.

As far as trading business is concerned, Gunvor has built presence in key markets supporting the energy transition, such as biofuels, natural gas, LNG, power, carbon emissions and base metals. It fully exited coal trading in 2018.

Details and examples on how the Group contributes to climate change mitigation are provided in the following sections.

E1-2This is small tooltip textPolicies related to climate change mitigation and adaptation

Gunvor has documented its policies and expectations in relation to Health,

Safety, Environment, Human Rights and Communities in a formal document

called “Group HSEC Policy”. Climate change is covered in the environmental

section of the policy.

The MDR-P section of this report provides further details.

Actions and resources in relation to climate change policies

Actions and resources in relation to climate change policies

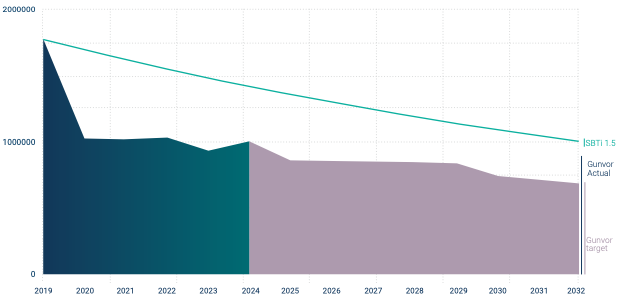

Gunvor committed to reduce absolute Scope 1 and Scope 2 greenhouse gas emissions by 40% by 2025, compared to a 2019 baseline, and aims to achieve net-zero emissions for its assets by 2050. This decarbonization trajectory is aligned with the Science Based Targets initiative (SBTi) pathway consistent with a 1.5°C global warming scenario.

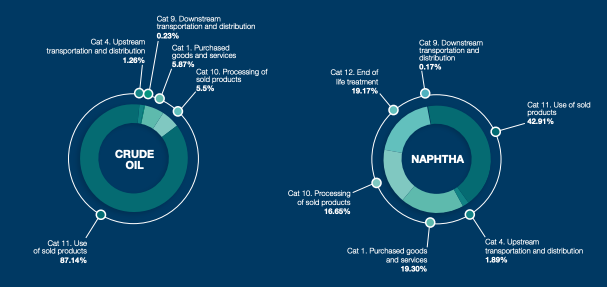

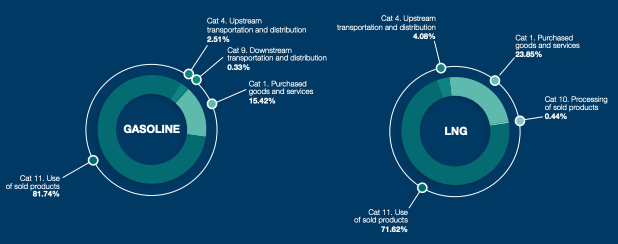

In relation to Scope 3 emissions, the vast majority of the emissions from Gunvor’s traded products are generated at combustion (over 80%), followed by emissions generated at extraction, production and processing. Transportation is the part of the trade upon which Gunvor has the most influence on, hence it is the focus of the Company’s reduction efforts. As such, it is committed to make its shipping operations more energy efficient and to reduce the CO2 intensity of its time and voyage charter fleet by 20% in 2027, compared to the 2023 baseline. The baseline had been reset in 2023 to reflect the new IMO calculation methodology that transitioned from tank-to-wake to well-to-wake shipping emissions. The target follows the updated Sea Cargo Charter (SCC) guidelines and is aligned with the IEA Net Zero Emissions path.

Since 2022, Scope 3 emissions arising from Gunvor’s trading activities are calculated, recorded, and systematically monitored as part of the Company’s broader emissions management strategy.

Gunvor is navigating the evolving environmental and market and scapes by diversifying its portfolio to include more sustainable or transitional commodities and businesses. In 2024, 28% of the trading portfolio included transitional commodities, as defined by the EU Taxonomy, and included products such as biofuels, natural gas, and LNG.

NYERA

Nyera (in Swedish: “New Era”), was established in 2021 as Gunvor’s dedicated vehicle for Energy Transition investments. Gunvor is looking to strategically invest along the value chain in assets that will support its trading activity and offer adequate return on investment. To date, Nyera has remained prudent in its approach, while focusing on long-term, sustainable businesses. Areas of interest for Nyera are diverse, ranging from more traditional renewables opportunities to entirely exploratory ventures.

For example, Nyera looks extensively at the deployment of capital in renewable power, such as solar, wind and biomass, both in terms of offtakes and investments. Nyera is also exploring opportunities in the alternative fuels space, in particular with ammonia and hydrogen, to support the commercialization of these fuels as part of the global energy mix. Blue and green hydrogen, specifically, have the potential to be commoditized, which works well with Gunvor’s overall business model.

Some projects undertaken throughout the year include the following:

Gunvor and Quercus announce landmark solar development partnership in Italy: The partnership aims to develop up to 3GW of solar projects from permit approval to ready-to-build status. It marks Gunvor’s first investment into the solar sector alongside renewable energy specialist Quercus.

Hydrogen Import Terminal: As reported last year, Gunvor and Air Products signed a joint development agreement for an import terminal in Rotterdam. The agreement responds to the accelerating demand for green energy sources to meet net-zero emissions climate objectives and the need to diversify energy sources.

Currently, construction activities are taking place for this project after recent completion of the foundation works.

Sustainable Aviation Fuel Manufacturing: Gunvor Group is partnering with VARO Energy to jointly develop a large-scale Sustainable Aviation Fuel (SAF) production facility at the Gunvor Energy Rotterdam site. Designed for operational flexibility, the facility should enable production of either 100% SAF or 100% HVO, supported by advanced pretreatment technologies. The final investment decision is anticipated by the end of 2025.

Energy efficiency initiatives at Gunvor refinery Ingolstadt (GRI)

In 2024, GRI implemented a targeted energy efficiency project focused on CO2 reduction, whereby the two existing saltwater coolers in the crude desalter area were integrated into the wash water feed/effluent circuit, enabling the recovery of previously unused energy to preheat the wash water. This optimization is expected to save approximately 0.6 MW of power and reduce CO2 emissions by around 1,100 tonnes annually.

Clearlake shipping’s Sustainability strategy in maritime operations

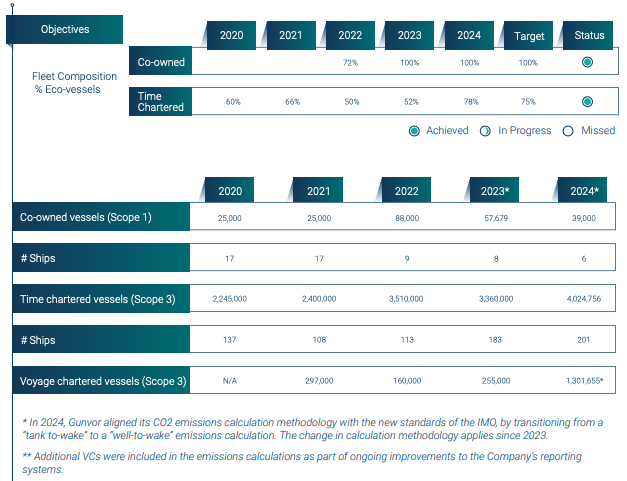

Singapore-based Clearlake Shipping, Gunvor’ shipping arm, is a leading global vessel charterer and is actively integrating sustainable practices in its maritime operations. Through Project ECO (Efficient Commercial Operation), Clearlake is working on implementing both hardware and software solutions to enhance energy efficiency and operational sustainability at the vessels. Clearlake operates a fleet of 6 co-owned vessels (as of end of 2024) and 201 vessels on time charter.

Enhancing Efficiency at Sea

Clearlake is committed to fuel efficiency and optimized vessel operations. Key initiatives include:

These measures align with international regulatory standards, including the IMO 2020 sulfur cap, GHG regulations, and the Energy Efficiency Design Index (EEDI) for newbuilds.

Technological Innovations and Hardware Investments

Clearlake is leveraging cutting-edge technologies to enhance environmental

performance:

Transitioning to alternative fuels & upcoming regulations compliance

Clearlake is actively exploring alternative fuels to reduce its carbon footprint,

including using LNG, methanol, LPG, and biofuels to power its fleet.

Own fleet:

Clearlake is fully set-up for the EU Emissions Trading System (ETS) and FuelEU Maritime regulations and remains committed to full compliance with evolving environmental requirements.

In-port performance monitoring and analysis

In 2024, a comprehensive solution has been introduced to enhance port

operations, delivering multiple benefits:

Targets related to climate change mitigation and

adaptation

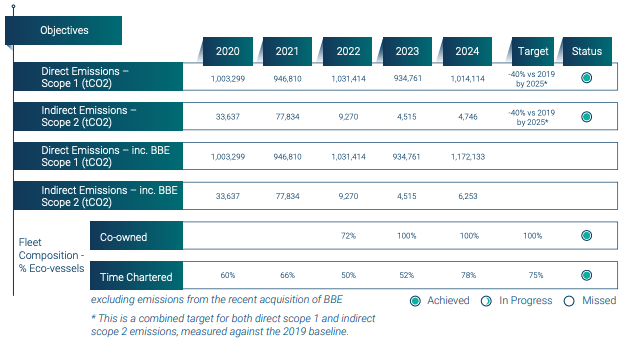

Performance overview table

Gunvor has established climate-related targets to support its climate change mitigation and adaptation efforts. Its primary focus is on reducing GHG emissions, through increasing energy efficiency, integrating renewable energy into the operations, or switching for alternative fuels, for example.

2024 Target and Performance Overview

Gunvor has committed to reducing its absolute Scope 1 and Scope 2 emissions

by 40% in 2024 compared to the 2019 baseline. This target has been achieved

and, Gunvor’s Scope 1 and 2 emissions for the period 2020-2024 are presented

in the table above. In the table above emissions from existing assets are outlined,

i.e. mainly Gunvor’s European assets such as GRI, GER, Spanish biofuel plants,

as well as emissions from co-owned vessels and offices. The reduction target has been set by reference to the year 2019 and the baseline is 1’782’389 tCO2

.

In 2024, Gunvor acquired a 75% participation in Spanish gas-fired power plant

Bahía de Bizkaia Electricidad (“BBE“) and Total’s 50% stake in Total Parco Pakistan

Limited (now Parco Gunvor Limited), a retail stations network in Pakistan. In 2024, BBE reported emissions of 408’722 tCO2 Parco reported 1’448 tCO2

.

To account for the emissions of the newly acquired companies, the GHG

protocol allows two approaches: adjustment of the baseline with the full year

emissions of the acquired company or adjustment with the emissions of the

acquired company in the period between acquisition and year end. The latter

approach, which is called the pro rata approach, is described in Appendix E

of the GHG protocol. We believe that this approach is most appropriate for

comparing the emissions with the target.

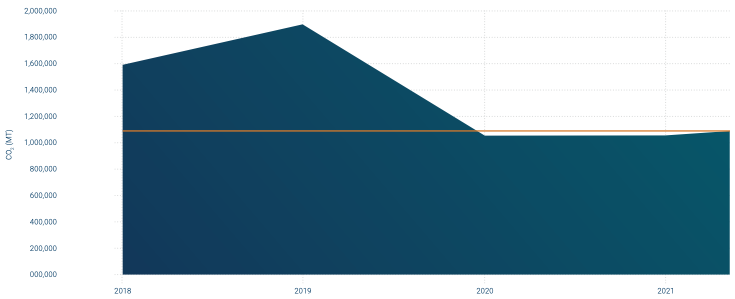

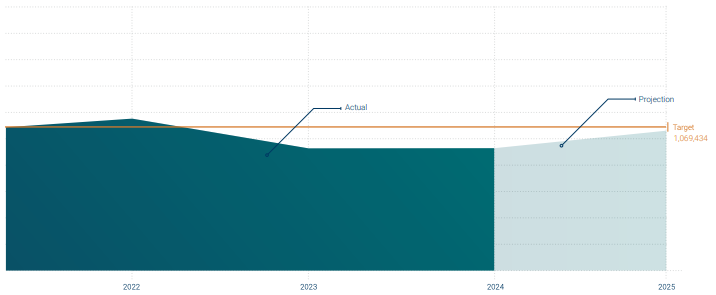

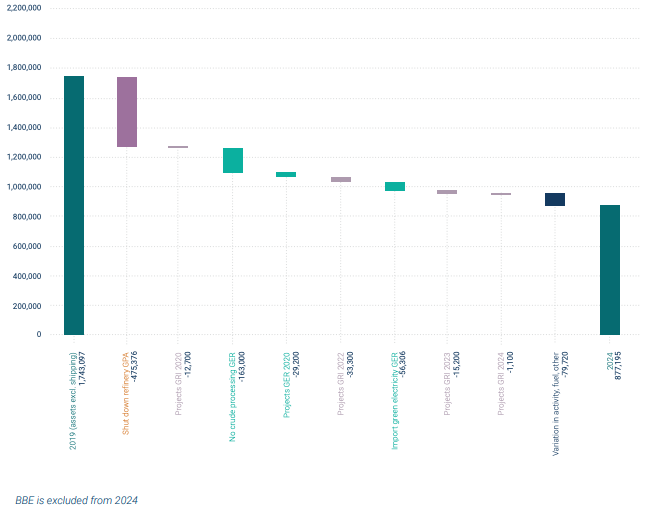

Scope 1&2 emissions reductions trajectories

About this graph: The graph shows Gunvor’s actual and projected emissions (excl. BBE)

Scope 1&2 emissions trend graph

About this graph: The graph shows our 2024 emissions, excluding the additional emissions from the acquisition of BBE. Based on this scope, we have met our 2024 emissions reduction target compared to the 2019 baseline.

Energy consumption and mix

Currently, Gunvor does not have the necessary data to fully disclose our

energy consumption and mix. There is a close relationship between the GHG

emissions disclosed in this report and the energy consumption. Therefore, we

choose to provide some qualitative and semi-quantitative information about

our energy consumption.

Based on our Scope 1 and 2 emissions an emission factor of 0.3 tonne CO2

/ MWh and considering the use of green electricity at our refineries, our total

energy consumption is in the order of magnitude of 5 million MWh.

The main energy consumers are the Group’s industrial assets (around 90%)

followed by its shipping business (around 10%). The type of fuel used in

shipping is mainly fuel oil, however the share of use of alternative fuels, such

as natural gas and other low carbon fuels, is increasing. The recently acquired

Spanish powerplant, BBE, uses natural gas to generate electricity. The refineries

use natural gas as well as fuel gas in Ingolstadt, as it is a by-product from the

refining of crude oil. The electricity purchased by the refineries in 2024 was

carbon neutral (e.g. nuclear or hydroelectricity). Gunvor doesn’t consume coal.

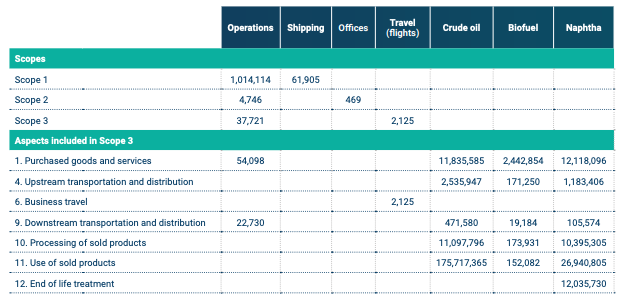

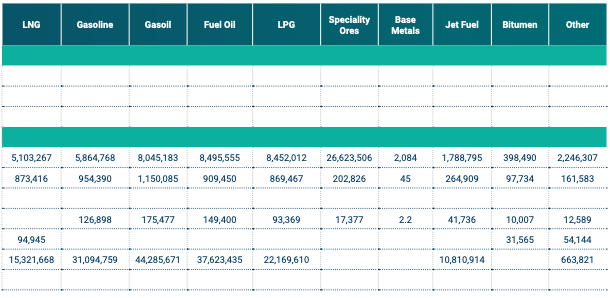

Emissions Tables

Gross Scopes 1, 2, 3 and Total GHG emissions

The trading, transport and refining of crude oil, petroleum products and other commodities are associated with significant greenhouse gas emissions. At this stage, greenhouse gas reporting is limited to the carbon dioxide (CO2) and methane (CH4) (currently limited to the refining sites and powerplant). Inclusion of nitrous oxide (NO2) and other greenhouse gases may be evaluated in the future.

Also, this year, our Scope 1, 2, and 3 (shipping) emissions have been verified by third parties. The emission data shared in this report is the following:

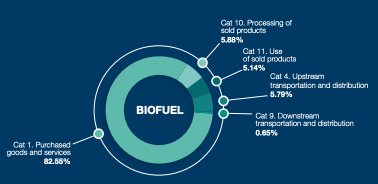

The full inventory of CO2 emissions along our supply chain is a complex endeavour and Gunvor works at improving the quality of the data shared year on year. In 2024, the emissions from 12 products were assessed with the help of Carbon Chain, a leading company in carbon footprint calculations. Looking at the Scope 3 emissions linked to the whole life cycle of the commodities it transports, the weighted average intensity of Gunvor’s traded book was 3.5 tCO2 /ton (same as in 2023).

The table details our CO2 emissions for 2024, specifying the Scope 3 subcategories considered in line with the Greenhouse Gas Protocol Technical Guidance. Further details on the total volume of Scope 3 emissions from traded products and other pertinent information are available in a separate section of this report. Additional information regarding our Scope 1 and 2 emissions for our operational sites and shipping activities will also follow in subsequent sections. The graph illustrating Gunvor’s CO2 trajectory and energy transition initiatives over the years is also presented in the following sections.

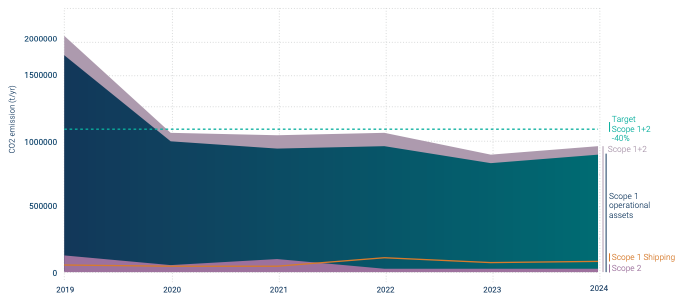

Gunvor’s CO2 Emissions (T/Year) (Scope 1&2)

Scope 1& 2 emissions trajectory:

The graph depicts the direct CO2 emissions from the operational sites, which are the refineries (GRI, GER), the biodiesel plants (GBH, GBB), the power plant (BBE) and the German distribution activities (GDG). It also includes indirect emissions from electricity purchase (scope 2). The data presented excludes the acquisition of BBE which took place in 2024.

The emissions declined sharply in 2020 due to reduced refining activity (shutdown of Antwerp refinery, shutdown of crude units at Rotterdam). In the following years a further reduction was achieved by several measures. We reduced the Scope 2 emissions by changing our electricity purchase contracts in order to only purchase green or nuclear electricity in our Rotterdam and Ingolstadt sites.

Gunvor’s commitment is to reduce the Group’s Scope 1 and 2 emissions by 40%. This reduction commitment against baseline 2019 was established in 2021 and is to be achieved in 2025. The acquisition of BBE in 2024 is expected to significantly change the Group’s emission profile. The plant is designed to serve as a backup generator when there is insufficient wind or sunshine, hence the emissions may vary strongly from year to year, and this will be considered when establishing new climate commitments.

Gunvor’s CO2 Emissions (T/Year) (Scope 1&2)

Transportation is the part of the trade where Gunvor has the greatest ability to influence emissions, particularly within Scope 3 categories 4 and 9 (Upstream and Downstream Transportation and Distribution). As such, it remains a central focus of our emissions reduction strategy.

Gunvor is working to reduce its shipping-related emissions through vessel efficiency, maintenance practices, operational optimization, and the use of alternative fuels and technologies. Measures include slow steaming, voyage optimization, energy-efficient ship designs, and low-carbon fuels. We are expanding our fleet through the construction of new LNG and LPG carriers, while monitoring the development of other low-carbon fuel technologies. At the same time, 100% of our co-owned fleet comprised Eco-vessels, and we met our target of having 75% Eco vessels under time chartering. We are also committed to improving the Energy Efficiency Operational Indicator (EEOI) across our chartered fleet.

Throughout 2024, Gunvor chartered over 600 vessels. One-third of these were time charters (TCs), while the remainder were voyage charters (VCs). Despite their smaller share of the total count, TCs accounted for approximately 75% of the fleet’s absolute CO2 emissions. As we are continuously enhancing our reporting systems and fleet performance tracking, in 2024, we identified a need to improve the way we count and calculate emissions for VCs. The results will be presented in the 2025 Sustainability Report.

CO2 Emissions related to traded products (Scope 3)

A large portion of the products that Gunvor trades is fuels. They contain carbon, which is released as CO2 when the fuel burns. Some products release more carbon per unit of energy than others and it is Gunvor’s aim to reduce the CO2 intensity of the company’s traded products. To that end, Gunvor has committed not to trade physical coal and is investing in renewables. Gunvor’s portfolio has evolved over the past years, towards commodities seen as participating in the Energy Transition in the European Taxonomy: Natural Gas, Liquefied Natural Gas (LNG), Biofuel.

In 2024, the total volume traded rose by 31% year-on-year, reaching 232 million metric tons, up from 177 million metric tons in 2023. The volumes of Natural Gas and LNG increased by 20% compared to the previous year on a nominal basis. Gunvor’s commitment to grow its Natural Gas and LNG trading remains firm.

According to the International Energy Agency (IEA), the global demand for liquid and gaseous fossil fuel is still increasing and will be a major part of the energy mix for many years to come. Gunvor is focusing on understanding the CO2 intensity in the supply chain of products it trades, including during exploration, transportation, production or refining, and end use. With the help of partners such as CarbonChain, Gunvor is analysing these emissions on several trades and several products. This increases our insight on where we can influence emissions.

Volume by product 2024

Volume History

C02 Emissions related to traded products

GHG Intensity based on net revenue

We do not have the necessary data to calculate and disclose Gunvor’s GHG intensity is based on net revenue. However, given the importance of this metric in assessing the emissions efficiency relative to financial performance, Gunvor aims to include this disclosure in future reporting cycles.

E1-7This is small tooltip textGHG removals and GHG mitigation projects financed through carbon credits

At present, Gunvor does not procure carbon credits to offset its emissions.

Gunvor has invested in a range of investments that support energy transition via its green investment vehicle, Nyera. The maturity of these investments is set to materialize in the following years. As a result of these activities, any carbon credit issued will not be internalized. Gunvor will continue to explore investments into other diverse high-quality low-carbon projects that closely align with the Sustainable Development Goals (SDGs).

E1-8This is small tooltip textInternal carbon pricing

Third-party carbon rating agencies are consulted for investment appraisals to perform due diligence on the quantification of carbon in the projects before they are presented to the investment committee. As part of this process, there is a thorough verification of both the operational and reputational aspects of each project that ensures transparency across the investments. Over the next reporting cycle, Gunvor will evaluate options for introducing an internal carbon price mechanism to better reflect potential future costs of carbon in its capital and operating decisions.

E1-9This is small tooltip textAnticipated financial effects from material physical and transition risks and potential climate-related opportunities

The current approach relies on qualitative risk assessments rather than detailed scenario modelling. Gunvor is developing a framework to estimate how evolving climate scenarios, climate policies, regulations, and market demand could affect our costs and revenue streams, with the aim of integrating quantitative impact forecasts by our future reporting cycles.