Basis for preparation

BP1This is large tooltip textRead more

The sustainability statement is prepared and presented as much as possible in accordance with Article 29(a) of the EU Directive 2013/34/EU, known as the Corporate Sustainability Reporting Directive (CSRD) and the associated European Sustainability Reporting Standards (ESRS). Since Gunvor Group is registered in the European Union and meets the eligibility criteria for the reporting, it is required to report in line with the newly introduced regulatory ESRS framework.

However, following the legislative update via the Omnibus package, the reporting obligation has been deferred by two years (first reporting now expected to be in 2028). Despite this delay, Gunvor has chosen to voluntary begin aligning its sustainability statement with the CSRD and ESRS requirements ahead of the mandatory timeline. The reporting on material sustainability topics covers our main value chain including impacts, risks and opportunities (IROs) identified across our activities and operations, as well as any other topics deemed of strategic importance.

In the following general disclosures, we provide a synopsis of the scope of our reporting, and we aim to address governance topics that encompass management responsibilities, sustainability due diligence and risk management. In addition, we include our strategy, business model, value chain, stakeholder interests, and other disclosed sustainability matters in relation to our Double Materiality Assessment (DMA).

The statement is prepared on a consolidated basis which follows the same scope as our financial statements referring to the period 1 January 2024 to 31 December 2024, i.e., Gunvor’s financial year. It includes the parent Company as well as our directly and indirectly controlled subsidiaries. Unless otherwise stated, our policies apply to all Gunvor entities, employees and everyone working under Gunvor’s operational control, which is defined as a position where Gunvor or one of its subsidiaries exercises full authority and implementation of policies at the entity in question.

Disclosures in relation to specific circumstances

BP1This is large tooltip text

Read more

Time horizon: We have considered the time horizons as defined in ESRS 1 par. 6.4, where short-term is the reporting period in the financial statements (0-1 years). Medium-term covers from the end of the short-term reporting period up to 5 years and long-term refers to anything more than 5 years (2030 onwards).

Use of estimates: To minimise risks of reporting errors or misinformation in regard to its ESG performance, Gunvor has established a series of internal controls and validation processes such as standardizing methodology reviews, data templates, assigning data owners and stewards that perform regular checks embedding the four-eye principle.

External review: To preparation of CSRD compliance, Gunvor’s external Group auditor (KPMG) has performed limited assurance on a selection of indicators in our sustainability statements – namely, GHG Scope 3 emissions, Air pollution, Health & Safety indicators, and our Human Capital KPIs. As the regulatory requirements are adapting to the growing political pressure on CSRD in Europe, Gunvor remains in a position to change its assurance type from limited to reasonable to comply with the adequate standard of reporting.

Changes in reporting: The reporting has been significantly expanded on sustainability disclosures to align with the CSRD and ESRS requirements, which is expected to become mandatory for our Company in the near future.

The role of the administrative, management and supervisory bodies

GOV-1This is large tooltip text

Read more

Gunvor Group, has established a robust governance framework to ensure accountability, transparency, and ethical business conduct across all organizational levels. A single-tier Board of Directors provides leadership and oversight of Gunvor’s strategy, risk management, and overall performance. Its primary objective is to uphold the long-term interests of the Company while ensuring accountability and transparency at every level of the organization. This accountability is further reinforced by Board committees, which examine specific matters in greater detail before presenting recommendations to the Board.

Key oversight responsibilities are divided among specialized committees, including the Audit & Risk Committee (responsible for monitoring risk and financial controls), the Compensation Committee (overseeing remuneration and incentive schemes) as well as the Compliance Committee. These committees help the Board maintain a clear focus on delivering strong, sustainable performance with integrity whilst safeguarding compliance with regulatory standards and upholding corporate values in business decision-making processes.

In line with Gunvor’s continuing efforts to improve governance practices, the Board formally reviews all major strategic and risk decisions, including the Company’s approach to sustainability and compliance. Oversight covers the Group’s commitments to transparent reporting, adherence to international regulatory frameworks, and robust compliance with relevant laws and regulations in the places we operate.

Role of the Group Compliance Committee

Gunvor’s governance structure is anchored by the Group Compliance Committee (GCC), which has steadily expanded its role since it was initially set up.

The GCC has formal authority to review and challenge all material compliance-related matters and is empowered with veto rights on critical business decisions. In 2024, the GCC continued to be composed of key senior executives from the Group’s legal, financial, and operational functions, ensuring representation of critical expertise and clear lines of accountability:

- Voting Members: Chief Legal Officer, Chief Financial Officer, Chief Operating Officer, and the Global Head of Ethics & Sustainability.

- Non-Voting Advisors: Senior advisors covering trading, internal audit, trading compliance, and other specialized topics.

The GCC convenes regularly to oversee the development and implementation of Gunvor’s compliance and ethics strategies. It also reviews potential new legislation or regulations, guides the management of any compliance breaches, and examines root causes to prevent recurrence. By bringing together multiple areas of expertise, the GCC ensures that compliance considerations are embedded within broader operational and commercial decisions.

The GCC reports directly to Gunvor’s Board of Directors on key risk areas and material compliance issues. This structured approach enhances transparency and ensures that significant matters receive the highest level of attention.

Compliance Expertise in Leadership

Gunvor’s Compliance Department has expanded to a global footprint of 36 professionals, distributed across core operational hubs:

This expansion facilitates localized expertise, timely risk mitigation, and comprehensive compliance coverage. Reflecting Gunvor’s deep focus on compliance, the team continues to review processes, oversee policy adherence, and identify new risk areas posed by complex international regulations.

Information provided to and sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies

GOV-2This is large tooltip text

Read more

Gunvor’s committees are regularly updated and informed on respective sustainability topics. The Group’s Health, Safety, Environment, Human Rights & Communities (HSEC) Committee is the governance body at a corporate level for Energy Transition, Human Rights and Health & Safety across our operations. It is chaired by Gunvor Group’s Chief Operating Officer (COO) and includes key Executive Committee members and the Global Head of Ethics and Sustainability.

Members of our HSEC Committee form a separate subcommittee for the operational sites called the Assets HSEC Committee, responsible for overseeing operational and environmental matters. This subcommittee is frequently briefed on Gunvor’s material impacts, risks and opportunities as part of a monthly internal CSRD updates. The updates include correspondence regarding DMA matters, data validation results as well as outlined impacts, risks and opportunities (IROs) across Gunvor’s activities.

This two-way structure ensures that issues are prioritised and addressed effectively at both corporate and asset (operational) levels, in alignment with our broader strategy, risk and performance management policies across the Company.

Integration of sustainability-related performance in incentive schemes

GOV-3This is large tooltip text

Read more

The remuneration policy for executive members is designed to align with Gunvor’s strategic priorities and long-term value creation. While the remuneration policy does not currently include specific sustainability-related key performance indicators (KPIs), Gunvor remains committed to integrating sustainability considerations into its broader management incentive plan.

Risk management and internal controls over sustainability reporting

GOV-5This is large tooltip text

Read more

Gunvor has established a structured risk management framework that includes the identification, quantitative assessment, and management of sustainability-related risks. These risks are integrated into the broader corporate risk management functions and are reviewed periodically by the HSEC committee. Key sustainability risks considered include regulatory compliance, climate-related financial risks, social risks and reputational risks as part of sustainability reporting. Risk assessments are conducted on an ad hoc basis through internal audits of our operating assets, stakeholder engagement, and internal consultations to ensure alignment with regulatory requirements.

In light of the upcoming CSRD reporting, Gunvor has expanded its internal control systems and is currently in the process of developing a new CSRD data management system which will benefit data accuracy and data validation processes whilst preparing for an increased scope of reporting as per the ESRS. Given the variety of data required to be collected as per the CSRD, the system will act as the backbone of the Group’s dataflows and will aim to provide an ongoing evaluation of risks concerning data accuracy and completeness.

As a fully integrated risk management department within Gunvor, the Compliance team operates a central Counterparty Management System (CMS) that acts as the centerpiece of Gunvor’s third party management controls, allowing it to identify and effectively manage compliance risks in a timely and effective manner.

Strategy, Business Model and Value Chain

Read more

Gunvor’s Strategy

Gunvor transports physical energy from where it is sourced and stored to where demand is highest, leveraging the most logistically efficient modes— ships, rail, trucks, and pipelines. While its roots are in oil trading, Gunvor has evolved to trade a broader mix of commodities in line with market demand. In 2024, transitional products (biofuels, natural gas, and LNG) represented 28% of the Company’s total trading volume.

Looking ahead, what Gunvor trade will reflect the global balancing act between affordable energy, economic growth, and the urgent need to reach net-zero emissions in response to climate change. Emerging opportunities lie in hydrogen, ammonia, and solar.

The Company’s growth over the past two decades— to become one of the world’s largest independent energy traders—stems from its agility and entrepreneurial mindset. Gunvor relies on advanced analytics for rapid decision-making, uphold strong governance and Compliance standards to manage risk, and harness digitization and AI to gain a competitive edge.

Gunvor also fosters a culture of openness, collaboration, and innovation. We empower our people to challenge ideas, contribute new solutions, and continuously drive improvement. As a global energy trader, we see significant opportunities ahead—to grow, diversify, and lead in the Energy Transition.

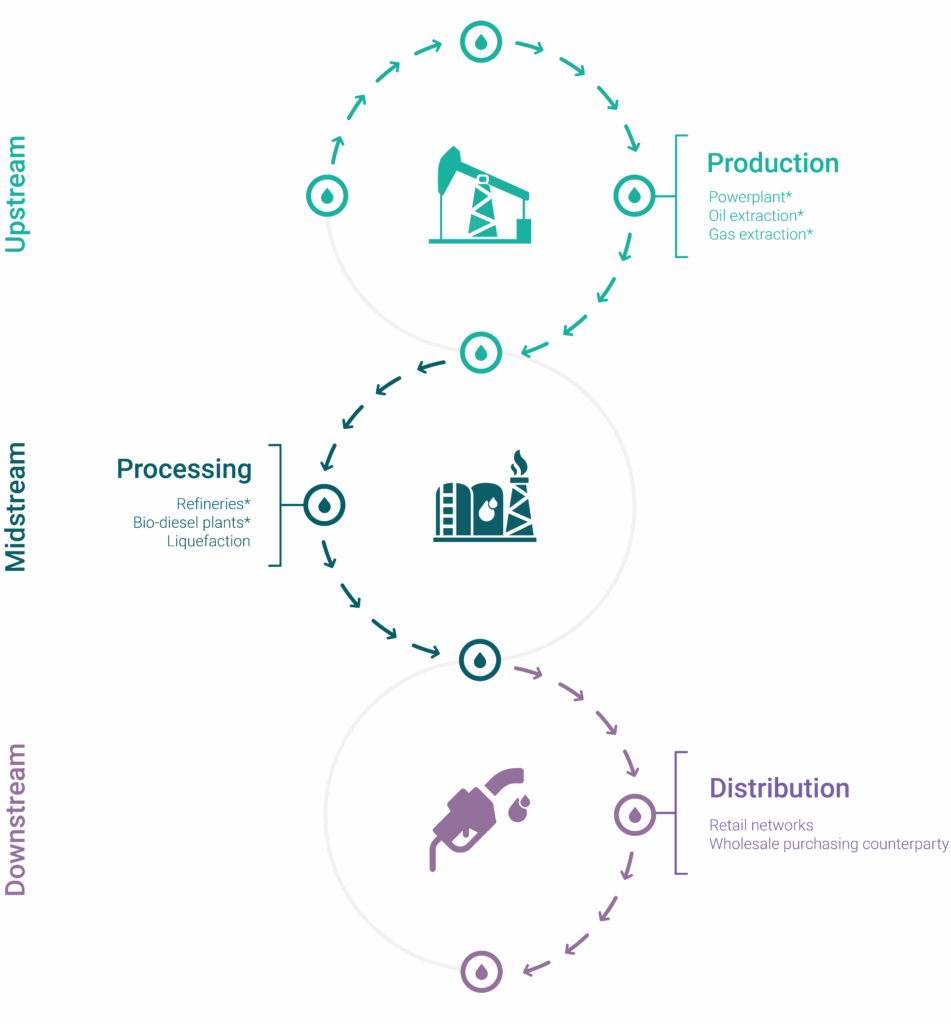

Value Chain

Gunvor’s own operations comprise different entities, joint operations, and joint ventures across the value chain. For the purpose of the ESRS disclosures and a more accurate understanding of the related impacts, risks and opportunities that arise from our material topics – we have segmented our value chain into upstream, midstream and downstream operations.

The upstream activities, such as product sourcing, span over a diversified global supply base to secure crude oil, refined products, LNG, natural gas, biofuels and other commodities.

The midstream activities, including logistics and shipping, are leveraged to ensure transportation of our products in an efficient and timely manner across the Group’s network. Another part of its midstream operations constitutes asset ownership and strategic investments in critical infrastructure, such as refineries, biofuel plants, storage terminals and pipelines that can be used to further refine and transport our products and meet client demand. As Gunvor’s presence across physical assets is growing, more recently with the acquisition of Bahía De Bizkaia Electricidad (BBE) – a power plant located in the north of Spain, it remains committed to navigating our sustainability disclosures in alignment with the growing regulatory landscape whilst following a robust risk management framework to mitigate risk.

The downstream operations make up a small part of today’s business landscape, however as part of its diversification efforts, Gunvor is exploring potential expansion opportunities in this area. In December 2024, Gunvor acquired Total’s 50% stake in Total Parco Pakistan Limited, a retail network of more than 800 services stations, fuel logistics and lubricants activities in Pakistan (now renamed Parco Gunvor Limited). With this acquisition increasing the complexity of its value chain, Gunvor remains committed to further examine how its IROs might be affected.

Our business model is deeply integrated across each stage of our operations, as the model revolves around physical trading operations where each link in the value chain plays a paramount role in achieving smooth operation.

Interests and views of stakeholders

SBM-2This is large tooltip textRead more

Gunvor’s stakeholders, both internal and external, play a crucial role in the Company’s ability to create and deliver value. Gunvor’s DMA and sustainability disclosures highlight the most significant topics for its stakeholders, reflecting key interdependencies and impacts across the value chain.

Material impacts, risks and opportunities and their interaction with strategy and business model

SBM-3This is large tooltip textRead more

Gunvor’s business approach and business model are structured to navigate the shifting energy landscape while maintaining financial stability. Our operations generate various impacts, risks, and opportunities (IROs) across environmental, social, and governance aspects. In 2024, Gunvor is voluntarily disclosing its material IROs in alignment with the ESRS for the first time, i.e., a year-on-year comparison is not available.

As part of the Sustainability Statements, the term “impact” refers to both actual and potential sustainability-related effects on people and the environment linked to our business activities. These impacts may be either positive or negative. “Risks and opportunities” encompass sustainability-related financial risks and opportunities, including those arising from dependencies on natural and human resources.

Unless otherwise specified by context, when referring to impacts, risks, and opportunities within the Sustainability Statements, these terms align with the definitions provided by the ESRS.

Gunvor’s evaluation of impacts, risks, and opportunities follows the double materiality principle, which requires assessing sustainability matters from two perspectives:

- Impact materiality – the actual or potential effects of our business on the environment and society.

- Financial materiality – the extent to which sustainability matters influence or are expected to influence Gunvor’s financial position.

A matter is considered material for reporting if it meets the criteria for impact materiality, financial materiality, or both.

Double Materiality Assessment (DMA):

DOUBLE MATERIALITY MATRIX (2024)

IROs TABLE

<<Need image here>>

Following the identification of the key Impacts, Risks and Opportunities (IROs), showcased in the table above, the Company will undertake detailed assessments to precisely determine how these IROs align across Gunvor’s value chain, clearly mapping their position and influence within the operational and strategic framework. Furthermore, each IRO will be categorised according to the relevant ESRS time horizons – short-term, medium-term and long-term to ensure proactive management ahead any regulatory requirements.

Own workforce

Own workforce  Suppliers and business partners

Suppliers and business partners  Customers

Customers  Shareholders

Shareholders  Banks

Banks Civil Society

Civil Society  Industry Associations

Industry Associations